Analysis of China's titanium ore market in the first three quarters of 2021

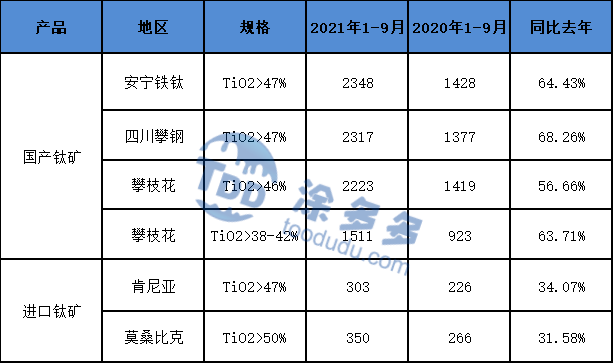

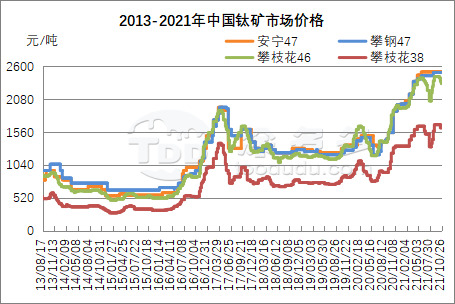

2021 first three quarters of China's titanium ore prices as a whole is rising, to small and medium-sized manufacturers, for example: three quarters of the market price is falling up, the end of the quarter than the beginning of the quarter prices rose from 2235 to 2428 yuan / ton, the price increase of about 8.68%; the first quarter to three quarters, prices rose from 1940 to 2428 yuan / ton, an increase of 25.15%; 2021 first three quarters than The price rose by 804 yuan in the same period last year, an increase of about 56.66%. From Table I to Table III, it can be seen that the prices of titanium ore in China have increased in various degrees in the first three quarters of 2021.

2021年前三季度中国钛矿价格整体呈上涨态势,以中小厂家为例:三季度市场价格呈跌涨态势,季度末较季度初价格从2235上涨至2428元/吨,价格涨幅约8.68%;第一季度至三季度,价格从1940上涨至2428元/吨,上涨幅度25.15%;2021年前三季度较去年同期价格上涨804元,涨幅约56.66%。从表一至表三可以看出,2021年前三季度中国钛矿价格均有不同幅度上涨。

(Table 1: Comparison of quarter-end at the beginning of the third quarter of 2021)

(表一:2021年三季度初对比季度末)

(Table 2: Average price in September 2021 compared with January)

(表二:2021年9月均价同1月对比)

(Table 3: Average price of titanium products in January-September 2021 compared with last year)

(表三:2021年1-9月钛产品均价同去年对比)

Price Analysis

价格分析

In the third quarter of 2021, the overall price of China's titanium ore market is rising trend, the price of titanium ore in large plants stable upward, individual small ore prices were first down and then up; July small ore prices continue last month's weak trend, individual titanium ore prices have 200-280 yuan / ton drop; into August after the small ore prices continue to rise, prices rose to the end of September 2435 yuan / ton, prices rose by about 380 yuan / ton.

2021年三季度中国钛矿市场价格整体呈上涨态势,大厂钛矿价格稳中上行,个别小矿价格呈先跌后涨走势;7月小矿价格延续上月偏弱走势,个别钛矿价格有200-280元/吨跌幅;进入8月份后小矿价格持续上涨,价格上涨至9月末2435元/吨,价格累计上涨约380元/吨。

In July, the price of large plant titanium ore stable mainly for the stability of the manufacturer's clientele, market transactions, large plant titanium ore price stability; small plant prices fell mainly for the Guangxi area power restrictions and production restrictions, market demand reduced, some miners have panic, prices have fallen; by the impact of environmental protection inspection, some mining plant production restrictions, coupled with the Panxi plant overhaul, the overall market price of titanium ore upward. August titanium ore market start low, and In September, the environmental protection group stationed in the Panzhihua area, titanium ore production is still low, and the downstream titanium dioxide market is affected by power restrictions in the middle of the month, the market demand shrinks, and the titanium ore market in the Panxi area is weak in both supply and demand. Market prices are firm. After entering the titanium ore market in October, some prices have fallen, mainly by the downstream market demand is weak and iron ore market downturn, the titanium ore market is weak; as the end of the year approaches, some downstream enterprises have the intention to stockpile, titanium ore market inquiries increased, low prices have stopped falling phenomenon, titanium ore market stabilization.

7月大厂钛矿价格稳定主要为厂商客源稳定,市场成交情况良好,大厂钛矿价格稳定;小厂价格下跌主要为广西地区限电限产,市场需求减少,部分矿商有所恐慌,价格有所下滑;受环保检查影响,部分矿厂生产受限,加之攀西大厂检修,钛矿整体市场价格有所上行。8月钛矿市场开工低位,及原料中矿货源紧张,随着下游钛白市场陆续恢复开工,钛矿市场需求有所提升;部分低位钛矿价格有所反弹加之厂家库存低位,矿商有所惜售,市场价格有所上调。9月环保组入驻攀枝花地区,钛矿开工仍旧低位,月中阶段下游钛白市场受限电影响,市场需求缩减,攀西地区钛矿市场供需两弱,市场价格坚挺。进入10月后钛矿市场部分价格有所走跌,主要受下游市场需求偏淡及铁矿市场低迷影响,钛矿市场有所偏弱;随着年底临近,部分下游企业有备货意向,钛矿市场询盘增多,低位价格有止跌现象,钛矿市场趋稳。

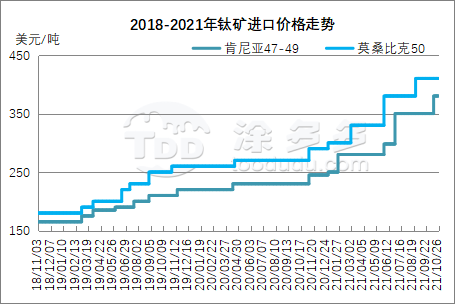

The first three quarters of 2021 imported titanium ore prices continued to rise, the end of the third quarter prices rose $110-130 / ton compared with the beginning of the year, up 36-50%. To the world's largest titanium ore companies Kenmeyer resources prices, for example, the first quarter prices were upward trend, prices rose from $ 300 to $ 30 / ton, up to $ 330 / ton, or 10%; the second quarter prices continue to move upward, prices rose from $ 330 / ton $ 30 to $ 380 / ton, or 9%; the third quarter prices continue to move upward, prices rose from $ 380 to $ 30 to $ 410 / ton, the price rose 7.9%. Imported ore prices rose mainly because: the international market titanium raw materials tension, tight supply of imported titanium ore; coupled with the South African riot RBM is still not fully recovered, titanium raw materials continue to be tight, and the outbreak of the epidemic in Vietnam, the titanium ore market transportation has an impact on the amount of imported titanium ore has been significantly reduced; and the high price of sea freight and container tension and other issues, the price of imported titanium ore continued to rise.

2021年前三季度进口钛矿价格持续上行,三季度末价格较年初上涨110-130美元/吨,上涨幅度36-50%。以全球最大的钛矿企业肯梅尔资源价格为例,第一季度价格呈上涨态势,价格从300上涨30美元/吨,涨至330元/吨,涨幅10%;二季度价格继续上行,价格从330美元/吨上涨30美金至380美元/吨,涨幅9%;三季度价格持续上行,价格从380上涨30美金至410美元/吨,价格上涨7.9%。进口矿价格上涨原因主要为:国际市场钛原料紧张,进口钛矿货源偏紧;加之南非暴乱RBM仍未完全恢复,钛原料持续紧张,及越南疫情爆发,对钛矿市场运输有所影响,进口钛矿量大幅减少;以及海运费价格高位和集装箱紧张等问题,进口钛矿价格持续上涨。

Post Market Analysis

后市分析

Affected by the double control, titanium enterprises upstream and downstream are restricted, titanium dioxide enterprises, although limited production, but the overall production, titanium ore demand, according to Tuoduo data show that the first three quarters of 2021 titanium dioxide production in 2,819,600 tons, an increase of 303,200 tons over the same period last year; the first three quarters of 2021 total titanium sponge production in 108,500 tons, an increase of 27,800 tons over the same period last year; corresponding to 2021 titanium ore demand has about 800,000 tons of growth. The first three quarters of imported ore compared with the same period last year increased by about 660,000 tons, about 400,000 tons of imported concentrates, domestic ore increased by 400,000 tons. The current downturn in the iron ore market, domestic enterprises inventory pressure, production will decline later, will affect the amount of titanium ore, downstream in the fourth quarter titanium dioxide and then new projects put into production, the fourth quarter titanium ore supply is still in a tight situation.

受双控影响,钛企业上下游都受到限制,钛白企业虽有限产,但整体产量提升,钛矿需求提升,根据涂多多数据显示,2021年前三季度钛白产量在281.96万吨,较去年同期增长30.32万吨;2021年前三季度海绵钛总产量在10.85万吨,较去年同期增长2.78万吨;对应2021年钛矿需求有80万吨左右增长。前三季度进口矿较去年同期增加约66万吨,进口精矿约有40万吨,国内矿增加有40万吨。目前铁矿市场低迷,国内企业库存压力较大,后期产量将会下滑,必将影响钛矿产量,下游四季度钛白再有新增项目投产,四季度钛矿供应仍处于偏紧态势。

- Up to 1,200V, 720kW Capability in China-made EV Charging Stations247

- 20 Best-selling Products for the Christmas and New Year Holiday Season362

- Hu Kun, Vice President of LLDD, Visited the Embassy of Kazakhstan in Singapore7014

- Liu Zhai, Senior Vice President of IBI, was Invited to Participate in the 2024 Modern Logistics and Supply Chain Industry-Finance Cooperation Ecological Conference and Hami City Modern Logistics High-Quality Development Conference7051

- LLDD of IBI Went to Ningxia Logistics Group for Inspection and Exchange9813